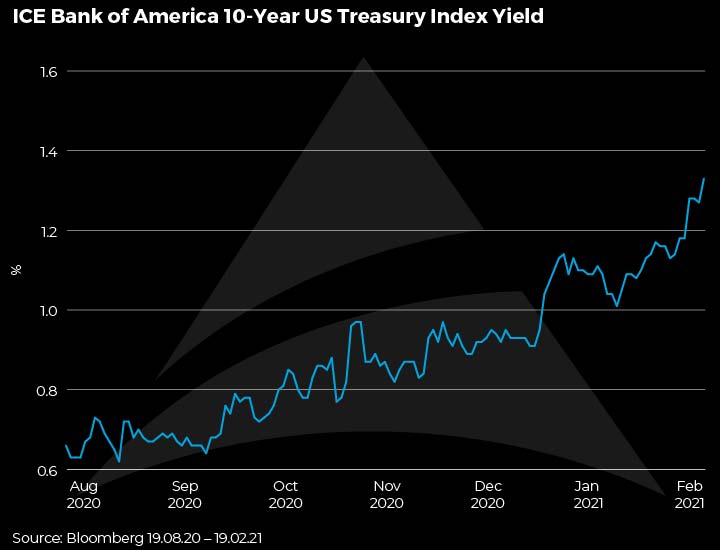

With the US dollar the globe’s reserve currency, as US treasury yields rise, the reference rate for borrowing across the planet also goes up. There is obviously a clear link between this “risk-free” rate and the rate at which “risky” entities borrow money, be they companies or other governments (typically emerging markets).

With the market awash with central bank liquidity and the expectation of a euphoric reopening of economies just around the corner, now is actually the time to start to tread very carefully. Risk-free assets have started to sell-off on the expectation of better times to come and risky assets have rallied for the same reason. However, this starts to create an uneasy equilibrium that will rupture at some point.

US yields on the rise:

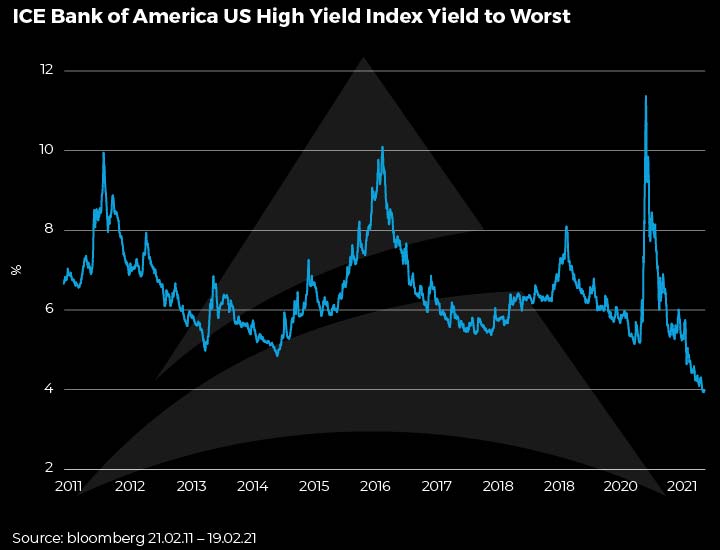

Against this junk bond yields (i.e. risky assets) are at record lows:

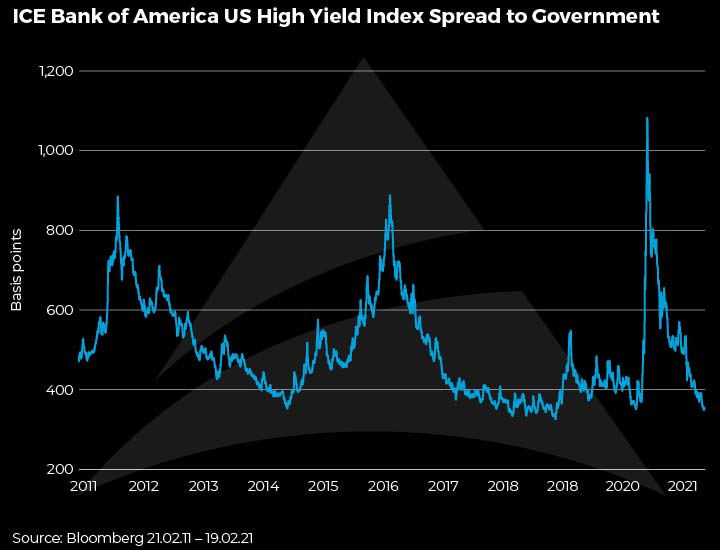

With junk bond spreads (spread in excess of the risk-free rate) nearing the lows:

Clearly this convergence in yields between risk-free and risky assets can’t continue and ultimately this relationship will break. One of two things are likely to happen, either risk-free yields go down or credit spreads go up. Given our expectations on growth for this year, we expect risk-free yields to continue to rise. The current uneasy equilibrium between risk-free rates and credit can also be extended to risk-free rates and emerging market debt and in addition, long duration equities (see It’s not just bonds that have duration)

A very positive backdrop for the global economy, but is GOOD now BAD?

*U.S. RETAIL SALES INCREASED 5.3% IN JAN.; EST. 1.1%

*U.S. JAN. RETAIL SALES EX-AUTOS, GAS RISE 6.1% M/M; EST. 0.8%

Last week’s price action on the back of good news out of the US is a microcosm of what this year could look like as a whole. In short, good news is now bad, because it’s potentially too good! Off the back of the positive retail sales data, we saw some weakness in credit, emerging market debt and equities because these markets have traded off the assumption that money will be free forever. A growth spurt this year kills that assumption dead!

For a long time, bad/benign news has been “good” for markets – it’s translated to more central bank liquidity, which has driven markets ever higher. But as the economy normalises and data really starts to get going, we fear last week’s price action will be repeated as rates rise further. In short, it gets to the point whereby we are not being paid enough to hold the risky asset, because the rate on the risk-free asset has moved so much.

We are going to get lots and lots of good data

To our mind central bankers are underestimating pent up demand. Whilst central bankers around the world are keen to reiterate the status quo of loose monetary policy continuing for some time, we think their hand will be forced sooner than they think because data will be just too good for them to ignore. We expect solid high single digit growth in all developed market economies this year, possibly approaching double digit. As we are seeing at the moment, even during lockdown, data has actually beat expectations! Driven by household savings, just think what will happen when economies actually reopen!

Stay out of trouble…

Clearly now is not the time to be loading up on risk. We prefer bonds where we have a clear line of sight of a positive total return in the short term. It is our sense there will be better opportunities to add risk to the portfolios as the year evolves.