Susceptibility of Change

Many businesses over the last couple of years have encountered incredible stresses on their business models, with lockdowns and stay at home orders having lasting impacts on their long term viability. Bricks and mortar retail along with the commercial real estate companies that house retail have been some of the hardest hit. For these industries in particular, the trends are not new and Covid has only served to accelerate this. Another example is the grocery industry in the UK being disrupted by the rise of the simple, low cost business models of Aldi and Lidl. As their market share surged over the last decade, this forced a change of strategy (and credit ratings) of the big four supermarkets in the UK.

There are many forms of disruption that businesses can endure and technology has been a driving factor. However, it is not just technology that is forcing businesses to change to remain relevant to consumers.

Don’t get disrupted by climate change!

Whilst tech driven disruption is still ongoing, the disruption to businesses as a result of the response to climate change may well dwarf anything that has gone before. The push to decarbonise economies is being driven from all angles – governments, the market, regulators, the people. It is consequently negatively impacting businesses on multiple levels and as an investor it is essential to be aware of, what we believe, will become a truly exponential trend.

As we stand, the political and social pressures for companies to adapt and change their ways has never been so great. Over recent times we have seen carbon pricing adoption across Europe and the signing of the Paris Climate accord. This year in the UK, we are hosting the COP 26, a further opportunity for countries to sign up to targets that will attempt to limit the degradation of the planet over the coming years. Businesses have to adapt, and quick!

Follow the money

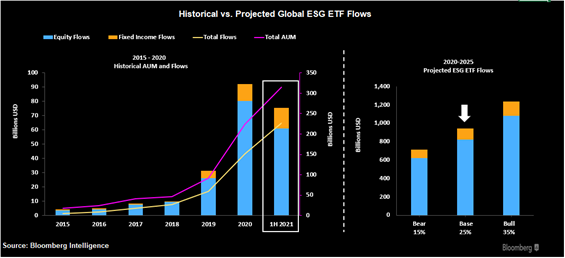

2020 saw a tidal shift in ESG investing. Bloomberg saw ESG ETF flows approaching $80bn and have an expectation of $800bn of inflows by 2025 now that the US is taking the climate more seriously. These are enormous numbers, growing exponentially.

ESG Projected Global AUM

For those companies positioned in ESG friendly sectors, such as wind farms or electric vehicles, these companies are enjoying the glut of money pouring into ESG friendly funds, making cheap capital a competitive advantage.

In contrast, those companies that are sitting on the other side of the proverbial ESG fence are facing increasing headwinds in terms of capital pricing. With less capital available to them, these companies are facing higher costs of capital. This vicious circle of higher capital costs and having to alter business models to adapt to the new climate change regulations is a grim mix. Whilst the autos sector has a relatively easy path to transferring from internal combustion engines to battery electric vehicles, given the end product looks and feels the same for the end consumer, others do not. What about oil companies? Their business model is to drill holes in the earth and release hydro carbons to the wider world! They have to dramatically alter their business models all the while investing vast sums of money in going after cleaner business segments, competing against pure play “green” companies which enjoy that lower cost and favourable access to capital markets.

Invest in the winners!

As responsible investors we are keen to support those companies who are on the right side of the ESG fence. Morally, as individuals and as a company, we understand it is the right thing to do. Financially though the case is compelling. As credit investors when we analyse a company we assess a company’s business risk and financial risk. As regulations go against companies on the wrong side of the ESG fence, returns are likely to diminish for their existing businesses. Whilst their access to capital markets diminishes too, increasing their financial risk, they are increasingly likely to face a reducing ability to access financing for their operations.

When we buy bonds for our portfolios, our key criteria is to ensure we are able to sell the bonds to someone else at a higher price or a tighter credit spread. It is likely fewer buyers of non-ESG friendly names will be around in future, making it harder to profit from those positions. As a result, ESG assessment of a particular company is a key determinant in the investment process. It is essential as investors that we are on the right side of disruptive trends because we believe we are about to see an exponentially disruptive trend the like of which the globe has never seen.