Europe’s industrial base is under pressure from global competitors with its legacy sectors like autos, steel, and chemicals being displaced. Assistant Fund Manager Kishan Paun highlights how Europe is grappling with declining competitiveness and rising inflation and how reforms in energy and industrial policy are essential for long-term resilience.

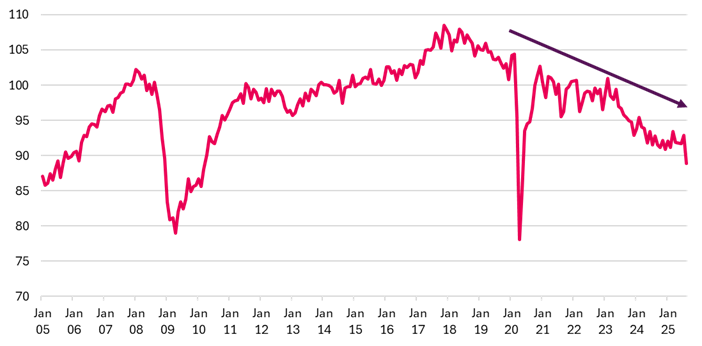

Europe’s industrial backbone is eroding. Chemicals, steel and autos, the industries that underwrote its post-war prosperity, are being steadily displaced by global competitors. German manufacturing, long the anchor of the continent’s economic model, has been in contraction since before the pandemic. A chart of German output makes the point clear: the European model of cheap energy, scale manufacturing and open markets no longer holds. Something must give.

German Industrial Production Index

Source: Bloomberg 31.01.2005 to 31.08.2025.

The China Shock

The most disruptive force in this new landscape is China. A deliberate, state-backed industrial strategy has generated structural overcapacity across the very sectors in which Europe once dominated. Subsidies for electric vehicles, batteries and solar manufacturing are several times higher than OECD (Organisation for Economic Co-operation and Development) averages, allowing Chinese firms to expand capacity at speed. When domestic demand faltered, Beijing turned to exports in preserving output and employment.

The result is a global challenge to European competitiveness. China has overtaken Japan to become the world’s largest auto exporter, shipping more than six million vehicles in 2023. Chinese automakers now compete directly with European peers not only in the EU market but also across Asia, Latin America and Africa. Indeed today, Chinese brands captured nearly 20% of passenger vehicle sales in Mexico. In many of these markets, Chinese models are priced 20 to 30 percent lower yet are increasingly comparable in quality and technology.

This is no longer a case of low-cost producers serving low-income buyers. It represents a full-scale restructuring of the global auto industry, in which Europe’s legacy brands face competitors with both scale and state backing. Chinese EVs already account for more than one-fifth of EU sales. Steel imports from China continue to rise despite existing duties. These are structural pressures that will not abate on their own.

The American Pivot

The United States has re-embraced protectionism with conviction. The new tariff measures under the Trump administration mark a clear departure from the old consensus of free trade and global integration. Washington’s strategy is explicit: rebuild domestic industry, reduce dependence on foreign supply chains, and assert economic sovereignty.

For Europe, this is a pivotal shift. The U.S. is not merely subsidising its green and industrial transition through policies like the Inflation Reduction Act; it is now actively reshaping the global trading order through tariffs and border measures. This creates a twofold challenge. First, European exports face a tougher environment in the U.S. market. Second, goods redirected from Asia and other regions will increasingly find their way into Europe, intensifying competition at home.

The Case for Protection

Europe remains caught between its liberal market tradition and the need to preserve strategic industries. The longer this hesitation persists, the more Europe risks becoming the passive recipient of other nations’ industrial strategies rather than the author of its own. At this stage, we believe that protectionism is no longer a political choice but an economic necessity. Europe cannot compete on open-market terms with nations that treat industry as a strategic asset rather than a market outcome.

Without intervention, Europe risks a slow erosion of its productive base, with each plant closure weakening its capacity to recover. Indeed, European chemical plants are operating at 70 to 75 percent utilisation, well below levels needed for profitability. Tariffs and industrial policy will not restore competitiveness overnight, yet they can buy time for deeper reform in energy and technology. In a world where every major economy now defends its own interests, Europe can no longer afford to remain the exception.

The Price of Protection

Protectionism, of course, isn’t a panacea. It will raise prices before any ensuing energy reform brings them down. Tariffs pass through to consumers, lifting the floor for goods inflation. With euro-area inflation still around 2.2%, new trade barriers will harden that base and may even reignite price pressures. For households, that means higher living costs. For policymakers, diminished room for manoeuvre. For investors, a world of higher nominal yields.

Our Stance

Europe stands between weak competitiveness today and the inflationary consequences of the protection it will soon adopt. Protectionism may preserve demand, but it will not restore global competitiveness.

We therefore remain underweight European industrials. The sector sits at the intersection of global overcapacity, high energy costs and policy uncertainty. Until energy costs fall and protectionist frameworks mature, the headwinds are stronger than the tailwinds.

Europe cannot resurrect its old industrial model, but it can manage the transition. Protection may arrive quickly, energy relief will arrive slowly, and inflation will be the price of survival.