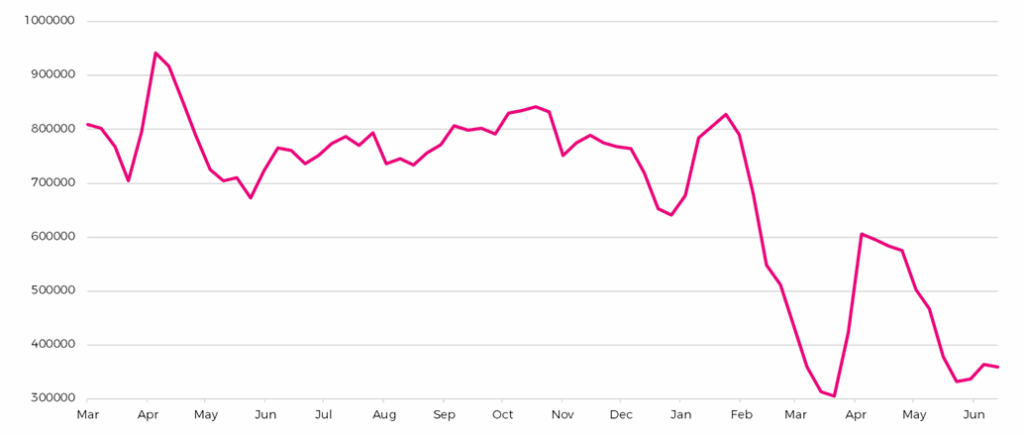

1) Liquidity

This is the overriding factor, which is normally the case in markets. It is no surprise that markets are rallying like it’s QE, because this is QE! The Treasury General Account (TGA) has been run-off to the tune of c$500bn over the last few months driven by the U.S. hitting the debt ceiling. When this happens, the country is unable to raise enough debt to fund itself. There is no alternative other than to raid the petty cash (TGA). With no net debt issuance and money flowing into the economy from the TGA, this is effectively just like QE and provides stimulus to the market.

TGA balance (trillions)

Source: Bloomberg 20.03.2024 to 02.07.2025.

Logically, the TGA run-off comes to an end post the “One Big Beautiful Bill” Act when at the very least, the TGA balance won’t keep going down at the same rate, so we will effectively get less QE.

To our mind, we have another source of synthetic QE coming from all this incredibly short issuance from the U.S.. Actual QE (all those years ago) was a form of maturity transformation – swapping long-dated bonds for overnight liabilities. This is not wholly dissimilar to what we have the moment; there’s a reluctance to issue long, instead the Treasury issues short in the bills market. This is proving to be stimulatory too.

Whilst the TGA run-off will come to an end, if Bessent’s comments prove to be accurate and the US Treasury continues to have a large skew to issuing short-dated debt, then there’s no end in sight to maturity transformation and the liquidity it provides to the market.

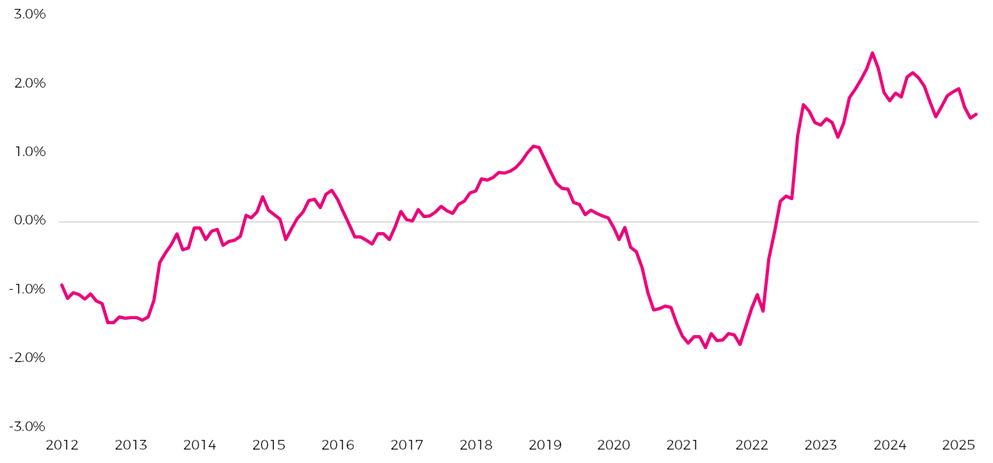

2) Real yields

We continue to get inflation-busting yields from relatively short-dated bonds. 5 year U.S. real yields are still solidly positive…

US 5 year real yields

Source: Bloomberg, data from 31.01.2012 to 30.04.2025. Past performance is not a reliable indicator of future returns.

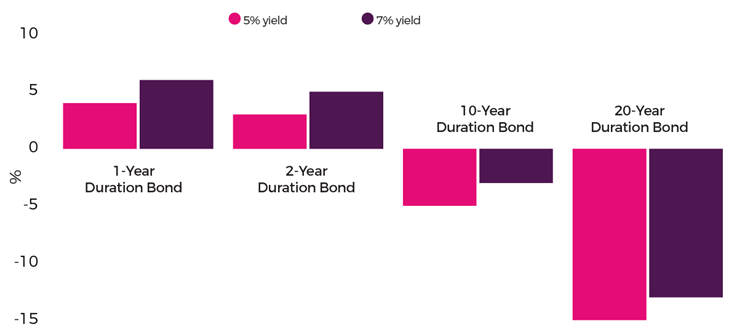

Add-on credit spread from relatively safe companies and from a risk/reward perspective the trade makes a lot of sense. In fact, at the short-end of the curve it really is just math’s! Even in a downside scenario of a 1% move up in interest rates, at the 1 and 2 year points in the curve it’s actually quite hard to make a negative real return…

3) Fiscal largesse

Whilst not impossible, it is fairly hard to have a recession when governments are spending quite so much money. This is obviously not only a feature of the U.S., but also the U.K., and much of Europe as well. When we get this high level of state expenditure it is only the truly over-levered and mismanaged companies that get caught out. Clearly these are of the high-yield variety, but for your average investment grade company which is not over-levered, the fundamental outlook is not too shabby at all; growth is ticking over for now because governments have no idea how to stop spending!

Potential bond performance from a 1% move up in bond yields

For illustrative purposes only.

So, with ample liquidity, positive real yields and fiscal largesse, it’s no wonder European short-term credit funds notched up their 19th straight week of inflows last week. The math’s just adds up!