I am trying my hardest not to sound wonkish writing this blog, but the difference between real and nominal growth and the effect it has on markets should not be underestimated. We obsess about “real” GDP growth in markets, that is the inflation adjusted variety. Whilst this form of growth is indeed the most relevant way of looking at the growth in an economy, for financial markets we should not entirely ignore the role that “nominal” growth has to play for asset values. That is, growth unadjusted for inflation. Another way of putting this is growth in Great British pounds or US dollars. The reason being is that the vast majority of assets are nominal in nature and are not inflation adjusted.

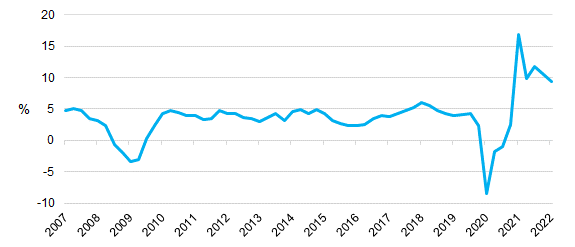

High nominal growth is something we have not experienced for a long time. It reached incredibly high levels during the pandemic and although it has come down from lofty levels, it is still very high versus recent history. Take the US for example:

US nominal GDP year on year % change

In nominal terms (i.e. in US dollar terms) the US is still expanding rapidly

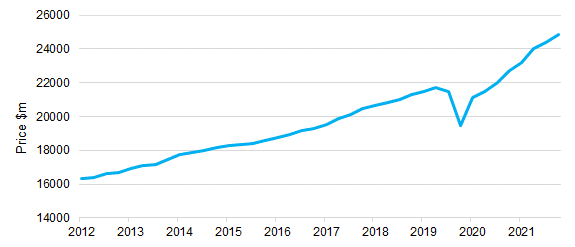

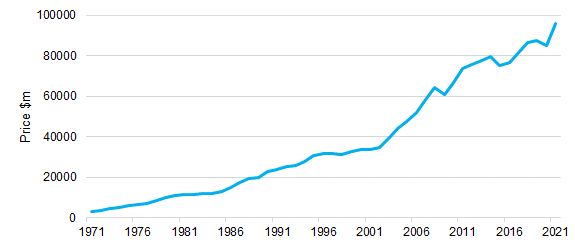

And so is the planet (global GDP in current US dollars)

The upshot of the continuing high inflation and the accompanying high nominal growth is that asset values are being devalued rapidly versus the US dollar size of the global economy. However, this vast amount of nominal growth, and the US dollars it is throwing off, clearly has to find its way somewhere!

Who benefits?

The big direct beneficiaries of all this inflation driven growth are the companies digging things out of the ground that have relatively fixed costs by comparison. Countries and companies with rich deposits of metal, minerals, agriculture and in particular, energy. The IMF has estimated that the energy-rich Middle East states will benefit from $1.3trn in additional oil revenues over the next four years. As has been the case in the past, these vast sums will get invested heavily into global markets. Indeed, it has recently been reported that the Saudi wealth fund sank more than $7bn into US stocks second quarter of this year (source: Business Standard, 30.08.2022).

So what does this mean for markets?

High nominal growth is arguably one of the reasons why we have not seen a catastrophic outflow-driven selling in markets; rather, there’s been a slow reassessment of valuation levels against risks to the global economy. Offsetting any selling, there’s been continuing buying from the beneficiaries of the nominal growth, whether they are countries, companies or individuals.

Aside from clearly being great for the resources sectors, it is also fairly good for banks too – their balance sheets have the potential to grow in nominal GDP terms, interest rates will have to continue to go up to bring nominal GDP growth back to trend, which means expanding margins for banks. In many ways, high nominal growth cements the thesis that we are undergoing a revenge of the old economy – outperformance of metals, miners, energy and banks.

Central banks are attempting to bring nominal growth down

Central banks are way behind the curve in trying to bring inflation down and thus nominal growth too. This is why we think high nominal growth will persist for some time and have the effect of supporting the market (in nominal terms, of course!) over the medium term.

Arguably, the US will have more success in reducing nominal growth compared to the rest of the world, partly due to the aggression of their central bank and thus exporting inflation through a stronger US dollar, and partly due to the lack of fiscal spending in the near term, when compared to Europe in particular. Nominal growth is likely to remain very high in Europe, given inflation itself has yet to peak and energy is an incredibly scarce resource.

The path of nominal growth from here on in is arguably as important for asset values as the path of real GDP growth. If nominal growth starts to drop rapidly, financial assets may take another leg lower, if growth doesn’t drop in nominal terms then maybe we don’t actually go a great deal lower or dare I say it, there’s a possibility at index level, we may have seen the bottom. Either way, the outcome for “real” wealth is less positive, except for those sat on things they can dig out of the ground, or those that are investing exclusively in the beneficiaries of nominal growth.