In this blog we will explain why and how we are using contingent convertible bonds to mitigate the worst effects of rising interest rates.

In general, fixed income corporate bonds and rising interest rates are not happy bedfellows. This is because as interest rates (risk free rates) rise, then the returns required by investors to hold other assets also rise. With equities that can happen through higher earnings and dividends, but with fixed income, the clue is in the name. The coupons are fixed at the time the bond is issued, so the only way that returns for new investors can increase is for the price of the bond to fall.

These price falls are also impacted by the duration of the bond.

Duration is a dangerous thing in an environment where interest rates are rising, and longer duration bonds are more volatile, as small changes in rates are amplified in the price of the bond.

So with that in mind, you might think that a perpetual bond, that is one that has no redemption date, would be the most volatile of all, and certainly one to be avoided in an environment where rates are rising. And that would be the correct conclusion.

So why on earth are we bullish on contingent convertible bonds (CoCos)? By regulation they are perpetual bonds and so should fall directly into the ‘avoid’ bucket.

But they don’t. How so?

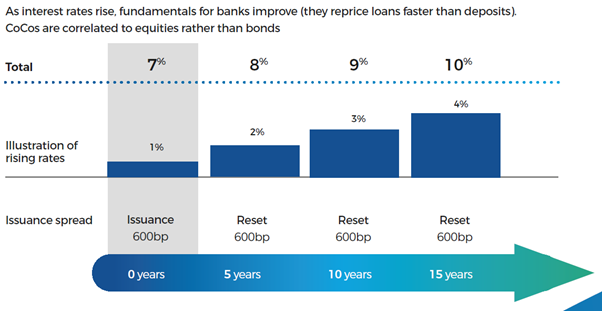

CoCos aren’t fixed income in the truest sense. They are indeed perpetual, but have periodic call dates on which the bank can call the bond if it is sensible so to do. When the CoCo is issued the coupon is set for a period of time, ranging between 5 up to 10 years for some of the newer bonds. On the date of issue the coupon is calculated as the sum of a risk free reference interest rate, say gilt rate, plus a “spread” over that interest rate. The spread is the amount an investor wants to be paid over the risk free rate in order to take on the risk of holding the bond. At the end of the first fixed period the bank either calls the bond, in which case the investor has received the agreed yield for the full period, or if the bond is not called then the coupon resets. What is crucial about the reset process is that the spread that was determined on the original issue date is retained, and added to the current level of the reference interest rate. In this way, if interest rates are rising, taking the reference interest rate up alongside, then the coupon will reset to a higher level than before. This process acts as a good insulator against rising rates and is shown graphically in the following chart.

CoCos

A structure that insulates the investor against the rises in interest rates

For illustrative purposes, to show the effect of a hypothesized rising rate scenario.

The chart shows a hypothetical CoCo issued with a coupon of 7% made up of a swap rate of 1% and a spread of 6%. The reset happens every 5 years in this case, and over the period rates are rising, driving the swap rate higher. At each reset the original spread is added to the prevailing level of swap rates, which in this example pushes the coupon higher at each reset.

These features can be put to work in a fund at times such as these. CoCos tend to trade as relatively short dated bonds due to this reset property. We have a strong preference for bonds with short-dated calls and high issuance spreads. These bonds are much closer to their first call dates, giving lower volatility. They also have high spreads, meaning that the likelihood of call is very much higher, again reducing price volatility. In addition, if, for whatever reason a given bond does not get called then the price is likely to immediately appreciated because of the higher risk free rate and hence higher coupon.

It is therefore possible to mitigate the worst effects of rising rates through a combination of choosing bonds with short duration, high coupons and high resets, while still focussing entirely on only the best quality banks and insurers.