For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

If someone had told me the US government would have been denying the shooting down of extra- terrestrials at the start of the year, I would have laughed at them in disbelief! However, it was true (in fact it was a large balloon) and it was an example of another event which was strangely not out of sync of the large-scale events we have witnessed in the world over the last 3 years.

The FCA recently commented that ‘asset managers need to manage liquidity effectively’, again highlighting the importance of ensuring there is continuing focus on understanding the liquidity of your portfolio. The global financial markets have faced extreme volatility due to the impact of seismic events such as Covid, the Russia-Ukraine War, an energy crisis, the UK having its shortest serving Prime Minister ever and even a banking crisis which has resulted in significant price movements for investors.

Predict the unpredictable

Events such as Covid and the UK political crisis are impossible to predict. However, although you don’t have a crystal ball, its vital to look at data and how you, as a bond trader executed trades during recent events, to give you an insight into how trading in future times of market stress may play out. This insight is like gold dust for the conversations around the liquidity of your own portfolio and whether you can trade the bonds you hold, when and where you want to.

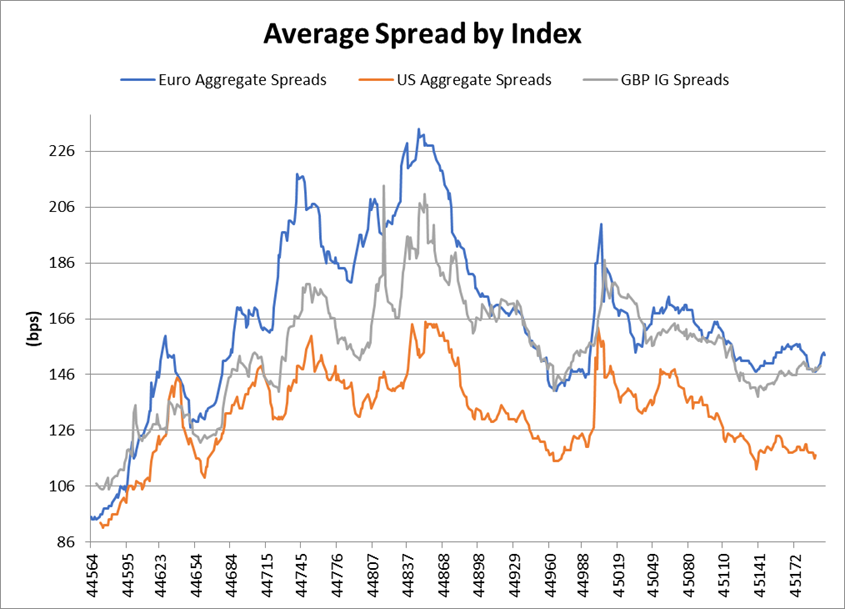

Volatile Spreads in Investment Grade Corporate Bonds

Source: Bloomberg data from 03.1.2022 to 29.9.2023

Clarity in a spread of market events

When Russia invaded the Ukraine in February 2022, the spread of the price to buy and sell Investment grade corporate bonds increased, as would be expected in times of stress. However, in the first month after the invasion, the spreads for higher quality bonds began to reduce and stabilise while lesser rated bond spreads remained elevated. Whilst this spread differential is prevalent between higher and lower rated bonds in normal circumstances, the liquidity provided by the market in investment grade bonds, especially higher quality bonds, was greater than bonds that were lower rated.

Whilst this fact may sound obvious it can’t be overstated. As an active fund the ability to enter and exit positions at levels with lower transaction costs is vital for performance especially in stressed market scenarios.

Last Autumn also saw another volatile market event when new UK Prime Minister Liz Truss unleashed a ‘mini-budget’ which caused mayhem in UK government bonds. The aggressive selling of gilts caused a large sell off and widening of sterling bond yields. Liability driven investors and Pension funds were forced to sell bonds to meet continued collateral calls. Again, spreads on the prices of bonds widened at this time and despite having to sell at lower prices, it was higher quality and bonds with a shorter term to maturity which proved to be the more liquid part of the curve to sell. For some funds it also provided the opportunity to buy high quality bonds at attractive yields and take advantage of the market sell off.

Finally, the recent banking crisis resulting in the takeover of Credit Suisse by UBS also provided a good barometer for the AT1 asset class in crisis mode as without warning the Suisse regulator wrote down AT1 ahead of equity. The asset class saw a significant sell off initially, but as regulators calmed and reassured the markets, there was a significant rebound in the prices of the bonds. Understanding the unique features and liquidity of the AT1 bonds held in a fund portfolio led to an understanding of how the market would react to such an unexpected shock to the banking sector. Despite many thinking it was the death of the asset class, it in fact provided one of the best buying opportunities in our view.

To boldly go where no bond trader has gone before?

It’s important to look at the data surrounding these major events and what parts of the bond market were possible to trade during these very volatile times – when markets are stressed and behaving to extremes.

Feeding back market reactions to the fund managers is a key part of the role when trading and isn’t a role that operates within its own silo. Experience is very much part of the investment process.

As a team we recognise that the trading detail needs to be part of the wider investment process tapestry. Often the learnings from times of stress and crisis can be applied when bond market waters are calmer – helping reduce transaction costs and improve the performance of the fund for the next fixed income maelstrom.

Each market event will be to a degree unique by nature and while the past doesn’t predict the future, history does tend to rhyme and repeat. This is where we have the knowledge to lean on of practical trading and data points based on how bonds have behaved in times of severe stress in the last few years.

As active managers, analysing the liquidity of the bonds in our investable bond universe is more vital than ever, allowing us to boldly go and discover new and exciting opportunities for our investors.