For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

It’s been a really great couple of years for the banking sector – after a decade or more of zero interest policy when every year that went by bank margins fell, suddenly banks have lots of margin to play with as interest rates have risen to more normalised levels. Return on equity has commensurately risen too, making banks look fundamentally sound given the fortress-esque balance sheets built up during the post financial crisis years. But whilst bank equity has responded to a degree, why are we still witnessing a price/book ratio of just 0.61 for the European banks index?

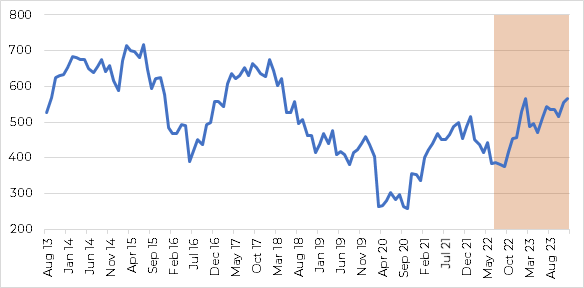

FTSE Eurozone Bank Index

Source: Bloomberg 30.08.2013 to 28.12.2023 Past performance is not a reliable indicator of future returns.

Bank credit (AT1) versus equity – both forms of capital look attractive

When looking at current valuations for AT1s and bank equity, both look as though they offer attractive returns, with the projected earnings yield of the FTSE Eurofirst 300 Eurozone Banks Index yielding 15.6% as at the end of December, according to Bloomberg, and the average yield to call of the ICE BofA Contingent Capital Index being 8.63%. Surely a free option to buy the equity over credit? Maybe not when we look to the future…

Margins are likely to have peaked

The past 18 months have seen a shift from a historically low interest rate environment to levels not seen since 2001 across Europe, and since the Global Financial Crisis (GFC) in the UK. As we go into 2024, are we going to see the same, accommodative rates environment? Money Markets are telling us no and as such we should maybe start to think that earnings have peaked.

Net Interest Margins (NIM) have been the main beneficiary as banks have passed on rate increases on loans much faster than they have on deposits, known as deposit beta. Markets are beginning to price in rate cuts in mid to late 2024, which will reverse the impact of profitable rate hikes we saw last year as loan yields decrease faster than deposits. This impact will be offset somewhat by banks investment securities portfolios and structural hedging, leading to a longer, flatter peak NIM rather than a sharp peak. Margins are still expected to be relatively healthy though compared to those post financial crisis years, so what really is the driver?

Banks are SHRINKING – there’s no shrinking to greatness in the equity market, but this is clearly not a terrible outcome for credit at 8.6%!

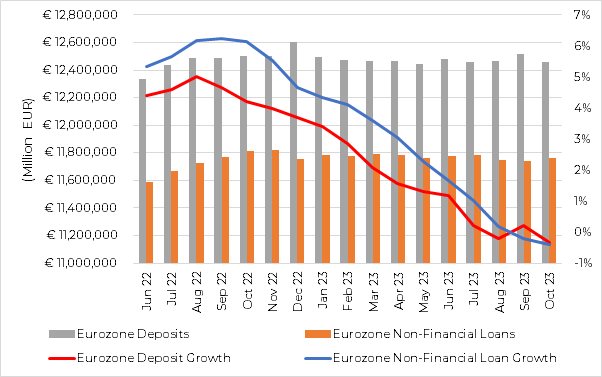

In addition, and possibly the greatest driver of equity valuations is the size of the loan book. When interest rates go up so much, businesses and consumers don’t go out and borrow more money. They do the opposite – where they can they reduce borrowings and hence it’s no surprise loan books are reducing, as well as a commensurate fall in deposits too:

Eurozone Loan and Deposit Growth YoY

Source: Bloomberg 30.06.2022 to 31.10.2023

Clearly this shrinkage is highly undesirable from an equity perspective – companies that are shrinking don’t typically have strong equity prices. For credit, the opposite is true – for a healthy institution, arguably getting healthier due to balance sheet size reducing against a static equity base – this is to be applauded in credit. Over time the bank is getting stronger, not weaker even though it is getting smaller. As we can see in the above graph, banks have just started to enter negative growth on both deposits and their loan book as a whole in the Eurozone, pointing towards a peak in EPS.

In addition, smaller balance sheets equal less bonds! So, the technical picture is also positive for bank debt.

Loan losses an equity story

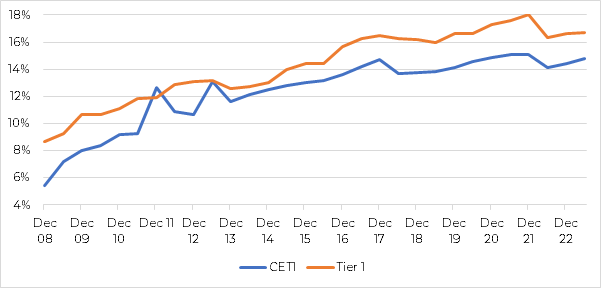

Despite a number of headwinds, such as a likely rise in arrears due to higher interest rates, we see this as another equity story, rather than credit. Firstly, banks have much higher capital levels than previously:

Banks Median Tier 1 Capital Ratios over time

Source: Bloomberg 31.12.2008 to 30.06.2023

And secondly banks are still sat on unused pandemic related loan-loss provisions, so any loan book losses will go to reduce equity payouts rather than be a credit event, especially from their current lofty levels.

In conclusion, credit has more certainty of return

Current yields on offer in bank credit are close to double digits but there are clear risks to the outcome for equity prices, given that it’s natural to respond to higher interest rates with debt reduction. Either way for the interest rate cycle, we think the outcome favours bank credit. If interest rates reduce, we get lower margin for banks, but the bank debt rallies, however if interest rates rise further or do not reduce at all then loan book reduction will continue apace, improving credit fundamentals In short, returns are likely to favour the AT1 holder over equity for the foreseeable future.