Duration is a measure of the sensitivity of a bond or fixed income portfolio’s price to changes in interest rates. A bond with a 2-year duration will move 2% in price if interest rates move up or down by 1%, a bond with a 5-year duration will move 5% in price if interest rates move up or down by 1%, a 10-year duration bond 10%, a 20-year duration bond 20% and so on. Hence more duration equals more price risk.

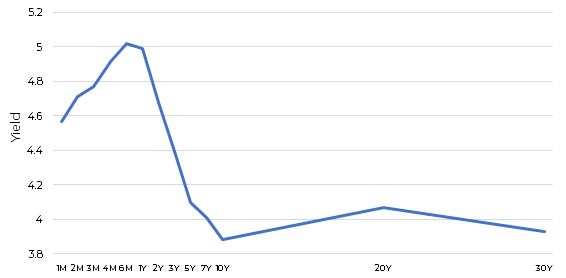

There has scarcely been a better time not to own duration risk, just look at the shape of the yield curve. Longer-dated bonds yield an awful lot less than shorter-dated:

US Treasuries Activities Curve

Source: Bloomberg 17.02.23

As an investor we have to pay to take on more risk. Logically then, it makes much more sense to own less risk for more return and be shorter duration. Whilst the yield curve exhibits the market bet that the Federal Reserve has hiked rates too far and the economy will slow sufficiently to tame inflation which will lead to lower rates in the future, the market has got this bet wrong for a while. We don’t deny that yield curve inversion does in fact signal recession, but it doesn’t signal when, and as we’ve seen recently the market could be waiting a long time.

A much more reliable indicator of recession is when the yield curve starts to price in rate cuts, something it is clearly not doing at present. In the meantime, as fixed income investors we are much better off rolling over short-dated bonds when they mature and earning a better yield. We can always add duration risk at a later date, when it’s clear we have labour market weakness, leading to less strong wage growth and hence less sticky inflation.

Short-dated government bonds may seem attractive, but short-dated investment grade corporate bonds are even more attractive because they trade with a “spread” or yield in addition to the yield on the government bond. Hence, it’s easy to see how at a particular part of the curve, high-single digit returns from relatively safe investment grade rated corporate bonds is achievable, giving investors a fighting chance at a real (inflation adjusted) return, especially when the interest from the bonds is compounded. And all this with relatively low amounts of price risk because of the low duration.