Six months ago, I was cautiously concerned about the impending ‘Winter of Doom’ descending on Europe. And winter is finally here now. Or is it?

Temperatures across Europe have remained unseasonably warm this winter, even recording the warmest recorded temperatures in multiple places. This unseasonal surprise has been very welcome for everyone waiting to see how Europe would cope in its first winter without Russian gas. And Europe has coped admirably. The TTF gas prices are down over 5x from their high of €311/MWh on 25th August to the current price of €57/MWh on 31st January. The gas price today in fact is also a third of the level that it was at the same time last year. This price level bodes well, not just for severely hit gas suppliers like Uniper (who expects a €19 billion loss as a result of replacing gas volumes) and SEFE, but also for all the governments who have capped the gas prices for their customers to ease the cost-of-living crisis. Let us examine some key factors that led to the fall of the TTF benchmark prices:

- Demand destruction: Warm weather has played a huge part in ensuring that the EU countries meet their gas demand reduction targets. In addition to the warm weather, different governmental incentives have also been key to cut demand across the continent. This demand reduction however came at the risk of the ‘deindustrialisation’ of Europe, with some major companies like BASF even saying that they would be downsizing permanently in Europe. Industrial gas demand in 2022 is approximately 20% lower than in 2021 (Source: International Energy Agency. How to Avoid Gas Shortages in the European Union in 2023 www.iea.org).

- Full storages: The main question that we faced back in August was the uncertainty of European nations reaching their mandated levels of at least 90% full gas storages by November. This uncertainty drove up volatility in the gas markets and prompted the gas prices to reach unprecedented levels. The prices were also pushed higher by countries trying to fill up their storages at any cost necessary. However, increasing delivery of natural gas flows from existing and new suppliers, in combination with record LNG flows to the continent brought the anxiety in the marketplace down to a simmer. Europe imported 60% more LNG supply to the continent than the year before.

- The Nuclear Story: There are two facets to the nuclear story in Europe in 2022. The first is the more commonly known French nuclear shortage disaster. The biggest electricity exporter in Europe, EDF, who had helped keep prices down across the continent, faced an unforeseeable summer of increasing nuclear outages, due to the corrosion found in many of its 56 reactors. Lack of nuclear energy in France prompted alternate sources of supply, and in an ironical twist, led to a delay in closures of nuclear plants in Germany and Belgium. Governments who had previously enforced early shutdowns of nuclear plants were now pleading with companies to keep them open. This delay in nuclear shutdown, particularly in Germany, has helped keep the lights on while keeping gas demand on the lower side.

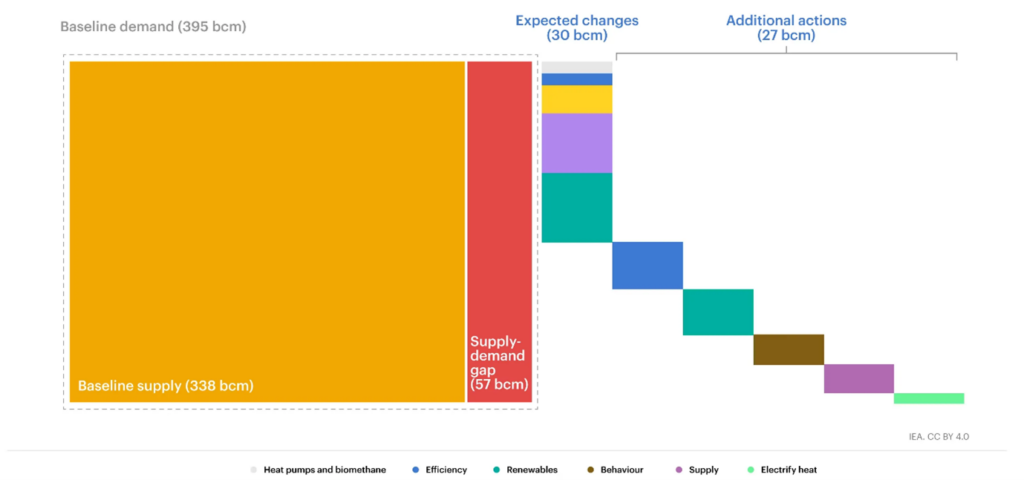

These above factors do point towards a lower gas price market in 2023, but some key challenges remain. In the first half of 2022, we still had Russian gas flowing into Europe, even though it became increasingly sporadic and eventually stopped. Without that initial flow, we would not be breathing easy right now. Along with lack of Russian gas, another factor potentially contributing to the supply gap is the reopening of the Chinese economy. Lack of Chinese demand in 2022 was instrumental in Europe being able to redivert massive LNG cargoes away from China. Now with China’s demand returning, LNG supplies could be very tight for Europe in the coming year. According to the IEA, there could be a supply-demand gap of 57 bcm in Europe this year, equating to ~14% of the total demand. The image below, illustrates the supply gap:

Expected changes and additional actions to close the supply-demand gap in the European Union in 2023

Source: International Energy Agency. How to Avoid Gas Shortages in the European Union in 2023 www.iea.org

If this gap materialises, it could bring back the frantic volatility to the gas markets. The volatility could prompt governments to step in once again in a period where they face high borrowing costs and inflation. According to the think tank Bruegel*, European countries have allocated and earmarked €705.5 billion since September 2021 to save their citizens from rising energy costs. To prevent the drama caused by the volatile TTF markets, the EU has put a price cap on TTF gas prices of €180/MWh.

Is there any good news amidst all this fear? A huge positive is that Europe is entering February with roughly 72% of its gas storages full. This leaves the continent in a very good position to exit this winter above the 50-55% gas levels that they wanted. As a comparison, gas storage levels last year were about 37% on 31st January and 29% at the end of February. This is a great starting point in the race to fill gas storages for the next winter.

Along with improved gas prices, there are many reasons for consumers in Europe to rejoice this summer. Unemployment has fallen to its lowest level recorded and workers are getting their highest wage rises since 2009. Industries have been supported by generous financing from their governments, and even tourism looks to make a strong comeback with a deluge of Chinese tourists looking to forget their woes of lockdown by roaming the sunny streets of Southern Europe.

With unemployment at record levels and wage rises over twice the inflation target, the European Central Bank (ECB) may have to remain more hawkish than what is currently expected. The ECB has just risen rates by an additional 50bps and has indicated that it is closer to the end of the rate hikes than the beginning – but a stronger than expected European economy might prompt the ECB to keep hiking its rates. The European Surprise Index is the highest it has been since 2010 (outside of pandemic government support), indicating things are rosier than they may seem. If that continues, bonds can continue to fall in the eurozone, something which may disappoint all those that have recently piled into fixed income looking for a reversion after last year’s slaughter.

We are in the latter camp and believe that the European economy will continue to benefit from opening up, low unemployment and wage rises – particularly across the lower rungs. All this points to upward pressure on European government bond yields and falling prices in the short term.

* Sgaravatti, G., S. Tagliapietra, G. Zachmann (2021) ‘National policies to shield consumers from rising energy prices’, Bruegel Datasets, first published 4 November 2021, available at https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices