My builder tells me there’s a shortage of cement and timber, the bike shop says there are no bikes and that tyres are now twice the price to source. The Ford salesperson can’t deliver a transit van for a year. There are semiconductor shortages. Is this going to alleviate any time soon? Unfortunately what we are seeing at the moment is going to take a while to work itself out.

Domestically generated inflation

There’s no greater example of this supply-demand imbalance than out of the U.S. last week. The Dallas Fed manufacturing survey detailed that labour, price and wage indices are all at all-time highs. This means that domestic inflationary pressures remain acute and are likely to spread further from manufactured goods to services as the world’s largest economy continues to reopen and savings get spent. But domestic inflation is only part of the issue.

Imported inflation

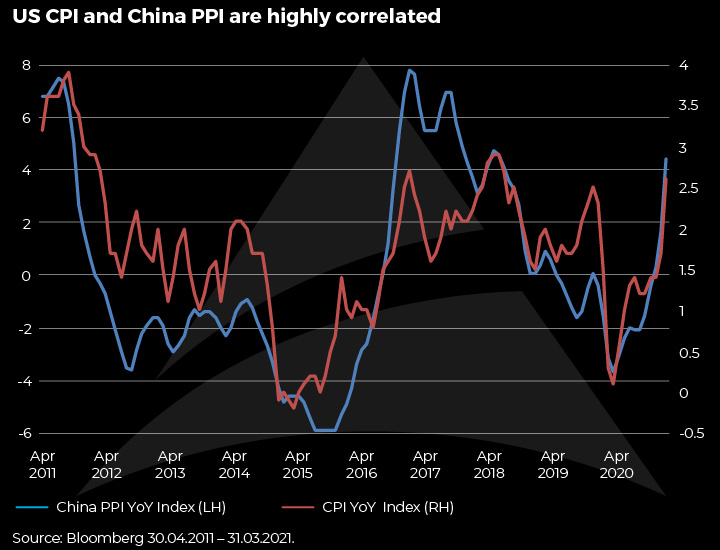

China’s Producer Price Index (PPI) is on the rise and it’s unsurprising given the number of containers leaving Asian ports for North America was running at record levels during April. Given China’s huge manufacturing base, PPI is very important for market expectations of global inflation, as we saw at the end of 2015 when we feared China could export deflation to the rest of the world. Well now it’s the opposite.

Further intensifying this issue of potential imported inflation is that developed market economies are way ahead with their vaccination programmes and getting on with reopening, whilst the emerging markets are lagging with vaccinations and are way behind in getting economies moving again. This will cause supply disruption from emerging markets to developed markets for the foreseeable future

This dynamic has been further aggravated by the Indian variant which threatens to overwhelm the subcontinent and nearby countries for some time to come with more virulent mutations getting ahead of the vaccination effort.

Imported inflation from supply chain disruption has the ability to exacerbate the huge supply-demand imbalance arising in many segments of the economy, because we in the west import many of our goods from developing countries. If the west rapidly opens up but much of the emerging market world is still in some form of lockdown and continuing to grapple with the effects of the virus, then demand will simply continue to outstrip supply because stimulus and a savings glut is driving unprecedented demand across many parts of the economy. Add to this the fact many prefectures in Japan have just gone back into lockdown and the global chip shortage is likely to be a feature of the rest of this year and into next.

Earnings evidencing inflation

Inflationary pressures evidenced in recent manufacturing surveys, such as- “..things are now out of control. Everything is a mess, we are seeing wide-scale shortages” (February 2021 ISM), are now starting to be widely talked about on company earnings calls. Barron’s had an article entitled, “Here’s What CEOs Are Saying About Inflation This Earnings Season”. Bloomberg ran an article titled “US Companies Bump Up Prices on Supply Squeeze and Demand Boom”.

Inflation is likely to remain elevated well into 2023, with inflation expectations starting to rise too as consumers experience the supply disruption first hand. We prefer not to be taking a great deal of duration risk in our portfolios until these dynamics work through economies and markets.