It’s the end of January and it’s clear to see that if this month is anything to go by we are in for a volatile headline filled year again! Despite the fear of Omicron subsiding and lockdowns easing, global economies and corporations are now faced with the difficulties of rising inflation and supply chain issues. Government bond yields have had significant moves higher since the start of the year. With rate rises on the horizon and with less central bank stimulus we are also seeing equity markets equally as choppy as bond yields. On top of this, there are geo-political risks with the threat of Russia invading Ukraine and this is only January! As a dealer for active credit funds, the question is am I ready for all this volatility and more specifically will I have the access to liquidity and the methods required for trading a wide range of credit bonds.

Not just what you trade but how you trade

As I have discussed before, the corporate bond market can be an extremely tough market to navigate and source liquidity during normal market conditions let alone the volatile ones we find ourselves in. I have been asked before why does it matter how you trade? However, something that is often overlooked is that another way of adding alpha is based on the method of how you trade your positions.

I remember reading articles and attending roundtables 10 years ago that highlighted that due to the regulatory demands placed on banks, the corporate bond market was in need of change as liquidity was going to fall off a cliff. Despite this, there was still often a reluctance to include and accept that technology would become part of the investment and dealing process for trading corporate bonds.

But fast forward to the present time and what we see is a different landscape with technology being used alongside voice trading for corporate bond trading. Traditional RFQ, accessing ETFs and alternative liquidity providers, lit order books, direct streams and portfolio trading are all now available to help in the challenge. Add in the traditional method of voice trading and there are now important decisions to be made on how you interact with the market.

One size doesn’t fit all

While there are numerous protocols, there isn’t a one size fits all. As a dealer for active funds, I try to understand and analyse the bonds (such as rating, currency, issue size, sector, size of trade) before entering the market as well as the motivation behind the trade, as this will impact the best outcome when executing your position.

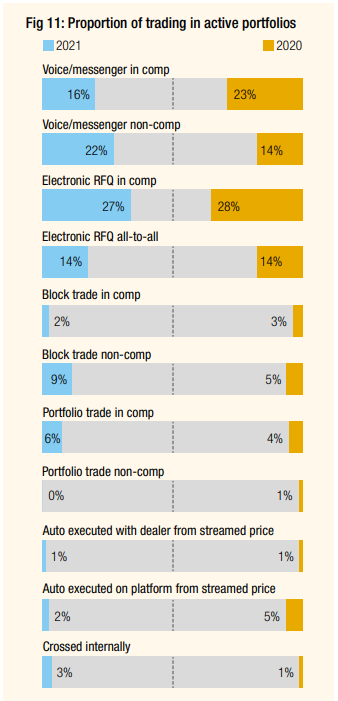

A recent report by The Desk (www.fi-desk.com/analysis-of-the-desk-this-years-complete-research-into-buy-side-bond-trading-desks) showed the variety of trading methods and changes that took place for active portfolios over the last couple of years. One of the most interesting statistics was the increase in non-comp voice trading which increased from 2020 to 2021 and an increase in portfolio trading.

Source: Markets Media Europe

To illustrate the point, the method used to trade a Sterling investment grade bond may not be the same method to trade a US Dollar AT1 bond. A EUR 1mm trade for a large issued Euro telecom investment grade corporate bond may have a wider range of pricing and axes available and therefore it could be suitable to ask a variety of counterparties in competition on an electronic platform. However, trading £5mm to buy a smaller issued Sterling High Yield Bond may require more sensitive voice negotiation involving counterparties who have inventory to minimise information leakage. Another example could be that a large list of European IG bonds aligned to an ETF could be more suitable for a Portfolio Trade rather than a RFQ list. Liquidity of bonds can be in constant flux and what is considered liquid one week could be less liquid the next as the market moves. Being ready to adapt your style using both quantitative data and your own trading experience is a key element to the investment process.

Each market has specific characteristics, liquidity profiles and market participants involved just as each fund manager, mandate, fund and set of trades can have different needs. By trying to understand the interaction between all of these factors and having access to all the relevant methods of trading for our funds, we can hopefully be ready for the choppy markets ahead!