When we talk about the short end we are not talking about the stature of this fund’s manager, although I am only 5ft high (or for those that prefer metric 152cm)! We are talking about the short end of the yield curve – those fixed income securities with short maturities and hence negligible price risk from movements in interest rates. Indeed, in our money market fund (Premier Miton UK Money Market Fund), we are talking very short maturities – those with less than a year to maturity and in many cases much less. Our fund has a weighted average life of just 102 days.

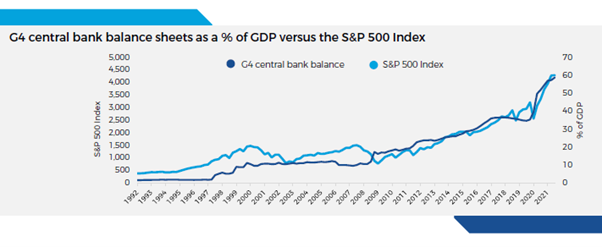

Markets of all descriptions have had an incredible run over the last few years and investors are getting wary of holding on to more risky assets that have provided them with so many gains, especially given that central banks around the world are keen to start raising interest rates and also reduce the size of their balance sheets. This week the Fed minutes signalled that balance sheet reduction was of utmost importance, and reduction will take place at a more rapid pace than previously. We know what this means for more risky assets – equities are highly correlated to the size of these balance sheets and a reduction in balance sheet size could spell danger.

Source: Bloomberg, 31.12.1992 – 31.12.2021.

Cash is king

Fortunately for us as money market managers, the market has moved swiftly at the short end of the yield curve to price in rate hikes. For example, in the UK the market has moved to price in a whopping 5 hikes from now until the end of the year. With a highly liquid maturity profile in the fund (16.8% maturing overnight, 21.1% in 1 week and 35.9% in 1 month), we are able to take advantage of this rapidly changing market pricing. For example we’ve been able to source very short dated, high quality corporate bonds such as single A rated BMW at over 1.2% for 5 months as well as single A rated Honda at over 1% with just over 6 weeks to maturity! We also topped up our position in Wells Fargo with less than 3 months to maturity at over 1%.

Short is back!

In short (excuse the pun), whatever the worry as an investor, whether it is liquidity withdrawal from central banks through balance sheet reduction, or the potential for WWIII, or simply a place to park cash from all those gains over the last few years, the short end is back! Offering safety and now return, given so many rate increases have been priced in by the markets.